About the Replacement Levy

-

Othello School District is seeking the replacement of our expiring levy, not a new tax, providing funds for essential student programs and operational costs not fully funded by the state. The current Educational Program and Operations (EP&O) Levy ends in 2023. The February 2023 levy simply replaces the expiring levy.

The EP&O levy provides funding for important programs and opportunities in our schools. Collection amounts are:

2024: $2,825,000

2025: $3,050,000

2026: $3,300,000Othello will also benefit from additional state funding known as Local Effort Assistance, provided to districts with low property values that pass local levies. Othello has a long history of supporting education through levy funding.

Your EP&O Levy at Work

-

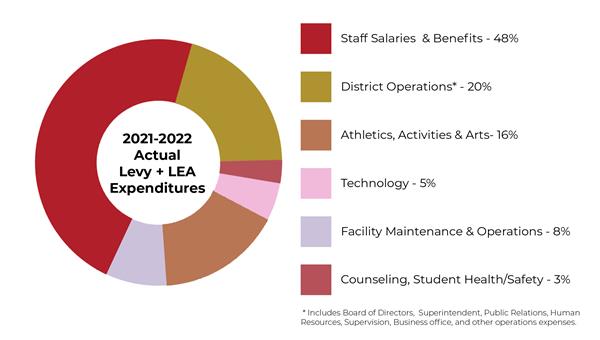

Levy funds help fill the gap between what the state provides funding for, and the actual cost of operating schools. The chart below shows how levy funds (including additional state Local Effort Assistance) were allocated in the 2021-2022 school year.

Frequently Asked Questions

-

How can I register to vote?

You can register to vote online at vote.wa.gov.

-

When are ballots due?

Registered voters will receive a ballot in the mail by the end of January. It it must be postmarked or placed in a ballot box by 8 p.m. on February 14, 2023.

-

What is a levy and how is it different from a bond?

Levies help pay for the operation and maintenance of our schools. Bonds pay for construction and renovation of facilities.

-

Is the replacement levy a new tax?

No. This levy replaces our current levy, which expires at the end of 2023.

-

How can I calculate my cost?

Total property assessed value divided by $1,000 x $1.50 = annual property tax for the OSD levy.

Example: Property has an assessed value of $300,000, annual levy taxes would = $450.00 ($300,000/$1,000) x $1.50.

-

How often does a school district run a levy?

Districts can run a levy every 1, 2, 3 or 4 years. We are seeking a 3-year replacement of our EP&O levy, which expires in 2023.

-

Doesn't the state fund schools? Why are you asking for a levy?

State, federal, and other funding sources provide approximately 89% of our annual budget. The local levy, along with Local Effort Assistance, makes up the rest. This helps fund programs and services that are either not funded or are not fully funded by the state.

-

What is Local Effort Assistance (LEA)?

LEA helps reduce the tax burden on districts with low property values by providing additional funding.

-

What if the levy doesn't pass?

Districts are typically forced to make cuts to programs and services that students benefit from if a levy fails. It can also lead to staffing cuts and larger class sizes.

-

What is required to pass a levy?

A simple majority of voters must approve a levy. That means 50% +1 must vote to approve.